Mortgage rates after fed rate hike: Homebuyers are rushing to lock in their bargains as mortgage interest rates in the US approach 5%. According to a story released by Reuters on Thursday, April 13th, Consumers rushed to make purchases before prices rose further, according to the Mortgage Bankers Association’s (MBA) most recent weekly survey, as the average interest rate on the most popular US home loan soared to more than 5%, the highest level since November 2018.

https://twitter.com/lenkiefer/status/1291736277285572611

In the week ending April 8, the average 30-year fixed-rate mortgage contract rate increased from 4.90 percent to 5.13 percent. In an effort to reduce economic demand in the face of high inflation, which has increased by more than 1.5 percentage points since the year’s beginning, the Federal Reserve has started to tighten financial conditions. Fed policymakers anticipate a series of swift interest rate increases until the end of the year at the earliest after lifting the benchmark overnight lending rate for the first time in three years last month. Investors anticipate that in 2022, the Federal Reserve will increase its target federal funds rate from its current range of between 0.25 percent and 0.5 percent to between 2.5 percent and 2.75 percent.

The central bank’s portfolio of $8.5 trillion in U.S. Treasury and mortgage-backed securities will also start to be reduced early next month. Throughout the COVID-19 pandemic, this stash of assets has contributed to low borrowing prices for consumers. To learn more, keep reading. These expectations for the Federal Reserve to adopt a more hawkish attitude have led to an increase in Treasury yields. Mortgage rates have had a difficult year, with the 10-year note yield reaching its highest level since 2018 and the typical 30-year mortgage contract rate increasing by 1.8 percentage points since the year’s commencement.

Homebuyers Beware:

Wall Street forecasts a wave of significant interest rate increases just as the cost of mortgages starts to rise. According to Fortune’s must-read, “Oil is approaching a New World Order.” Here is a list of the winners and losers. According to Wall Street, which is pleased with the Fed’s recent policy change, the period of extremely low-interest rates is over. In an effort to curb spending and contain inflation, the central bank is implementing a number of rate rises.

The change in policy has already caused a rise in 30-year mortgage rates, which have already crossed the 5 percent threshold for the first time since 2013. Mortgage rates are directly influenced by ten-year Treasury yields, which is why the central bank does not determine them. Mortgage rate movements can be predicted well by looking at long-term Treasury yields.

What is the highest interest rate that might possibly arise?

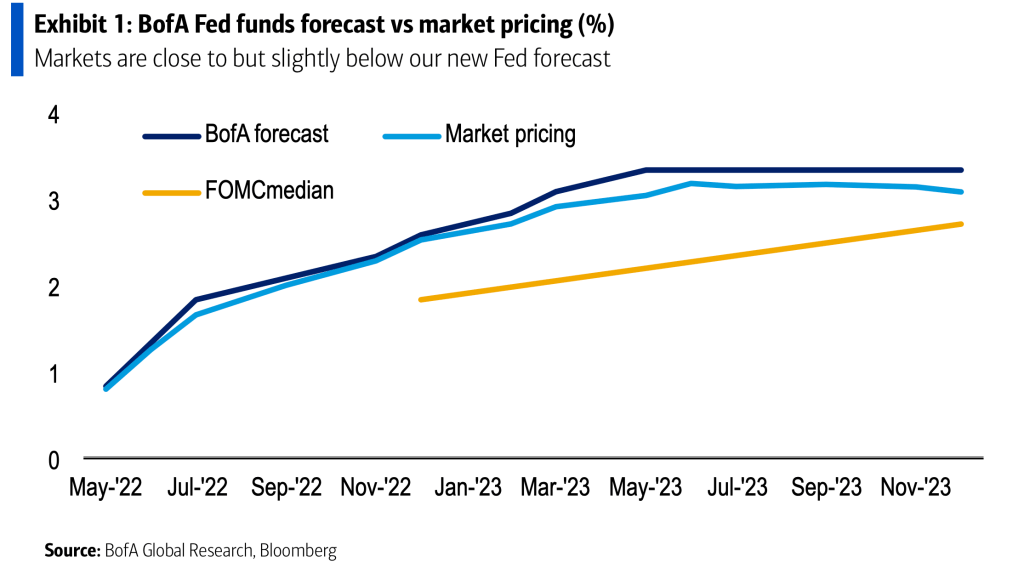

After the Federal Open Market Committee minutes were made public yesterday, BofA Securities issued an investment note in which it was predicted that Jerome Powell and his colleagues would begin a run of three consecutive 50-basis-point rate increases at the meetings in May, June, and July. Every meeting following that, up until May 2023, BofA economists forecast rises of 25 basis points. The Federal funds rate is expected to increase from its present level to 3.25–3.50 percent if things calm down, which could further destabilize the already erratic U.S. housing market.

Despite the overall decline in demand since the start of the year, mortgage application activity increased somewhat last week as homebuyers rushed to lock in interest rates before they increased even more. The MBA reported that while the refinance index fell by 4.9 percent, the purchase composite index, which tracks all single-family home mortgage loan applications, increased by 1.4 percent. Mortgage originations will drop by 35.5 percent to $2.58 trillion in 2022 from $2.58 trillion in 2021, according to the MBA’s most current economic forecast. Purchase originations will increase by 4 percent from last year to a new high of $1.72 trillion in 2022, according to predictions.

Here are their positions in the list:

Ethan Harris and Aditya Bhave, analysts at BofA, claim in a report that “markets are close to our view.” Quantitative tightening, or QT, will also be closely watched by the market. The Fed accumulated Treasury and mortgage-backed assets during the outbreak to prevent the economy from collapsing during lockdowns. The Federal Reserve announced earlier this week that it will start to decrease its $9 trillion balance sheet, indicating that the market monster is finally making a sizable exit.

The central bank said that it will choose not to roll over its maturing Treasury notes and instead let them run their course. On the other hand, an outright sale of mortgage-backed securities (MBS) is under consideration. The Dallas Fed concluded that, at least temporarily, the Fed’s MBS buying binge did cut homeowner mortgage rates. On the other hand, it takes some time for mortgage rates to reflect the change’s effects. Treasuries, a measure that is in doubt, are something potential homeowners might want to keep an eye on. The 10-year Treasury was pushed to an intraday high of 2.656 percent by yesterday’s Fed action, a level last seen in 2019, according to Deutsche Bank.

In order to determine what increasing mortgage rates mean for homeowners, Fortune contributor Lance Lambert crunched the figures. For a borrower with a $400,000 down payment on their home, a 30-year mortgage at a 4.67 percent interest rate (reminder: it reached above 5 percent yesterday) would need a monthly payment of $2,067. The US Federal Reserve System, the nation’s central bank, predicts that interest rates will increase three times in 2022. Additionally, it is accelerating the removal of financial aid that was given as a result of the outbreak. (hikeaddicts.com)

What are interest rates, exactly?

The cost of borrowing money is gauged by the annual interest rate. One of the main tools available to central banks in their battle against rising prices is inflation. As the global economy recovers from the pandemic, which has resulted in rising demand and supply shortages, inflation is surging. Therefore, the central bankers, who are in control of each nation’s currency and monetary policy, take action. The European Central Bank and the Bank of Japan, the two central banks that choose interest rates for the 19 European nations that use the euro, are both cutting economic support even though they have not yet lowered interest rates.

Mortgage and other financing rates of interest

If you obtained a mortgage in the UK to purchase a home, the monthly payment can increase. The magnitude of the loan affects the amounts. According to UK Finance, a trade group for the banking industry, interest rate increases of up to £15 per month are anticipated to have an impact on the typical mortgage of £140,000. Tracker mortgages, which have variable rates, are held by 850 000 of these persons. For them, this is. According to UK Finance, up to 74% of home loans in the UK have fixed rates, so if you have one, you might not notice a change. According to the statement, the bulk of debtors’ monthly payments wouldn’t increase right away.

Rising prices and a scarcity of supply

The typical home’s price has increased from around $215,000 at the start of the pandemic to more than $280,000 in recent years. The 19.2 percent spike in property prices in January alone dwarfs the annual gain in home prices in the United States prior to the 2008 housing boom. The quick increase in real estate prices is mostly caused by the dearth of available homes for sale. The United States has underbuilt housing by 5.5 million to 6.8 million homes over the previous 20 years, according to a 2021 National Realtors Association research.