Iron Ore Price News: Iron ore prices have stopped rising after a year of growth. Investors are worried about the construction output in a significant market, which is harming the Commodities used in steel production. The price of iron ore, a key source of profit for some of the biggest mining corporations in the world, has given up all of its gains for the year so far as investors become concerned about slowing Chinese demand.

https://en.wikipedia.org/wiki/Iron_ore

Following rumors that Chinese steel mills were decreasing output, iron ore plunged 8% on Monday, reaching a six-month low of $111.35 per tonne, according to S&P Global Platts. Losses had occurred for nine days in a row. Analysts have cautioned that it may drop below $100 a tonne for the first time since November if China’s failing property industry does not revive. The nation produces around half the steel consumed worldwide, with iron ore serving as the main raw material. Construction starts have not been considered, and orders have finally ceased, according to Colin Hamilton, head of commodities analysis at BMO Capital Markets. “Steel mills must immediately reduce output,” as a result.

Traders claimed that videos on WeChat, a well-known social media platform in China, purportedly displaying massive steel stocks had frightened the market. Housing accounts for up to 40% of China’s steel consumption, but this year, new home development has decreased as a result of Beijing’s efforts to control prices and debt loads at major developers. According to Hamilton, the month of May was especially bad, with a decline in new beginnings of between 30 and 40 percent from the previous year. In May, China’s annualized steel production, which has likewise been steady, exceeded 1.1 billion tonnes.

The steel market has suffered as a Result

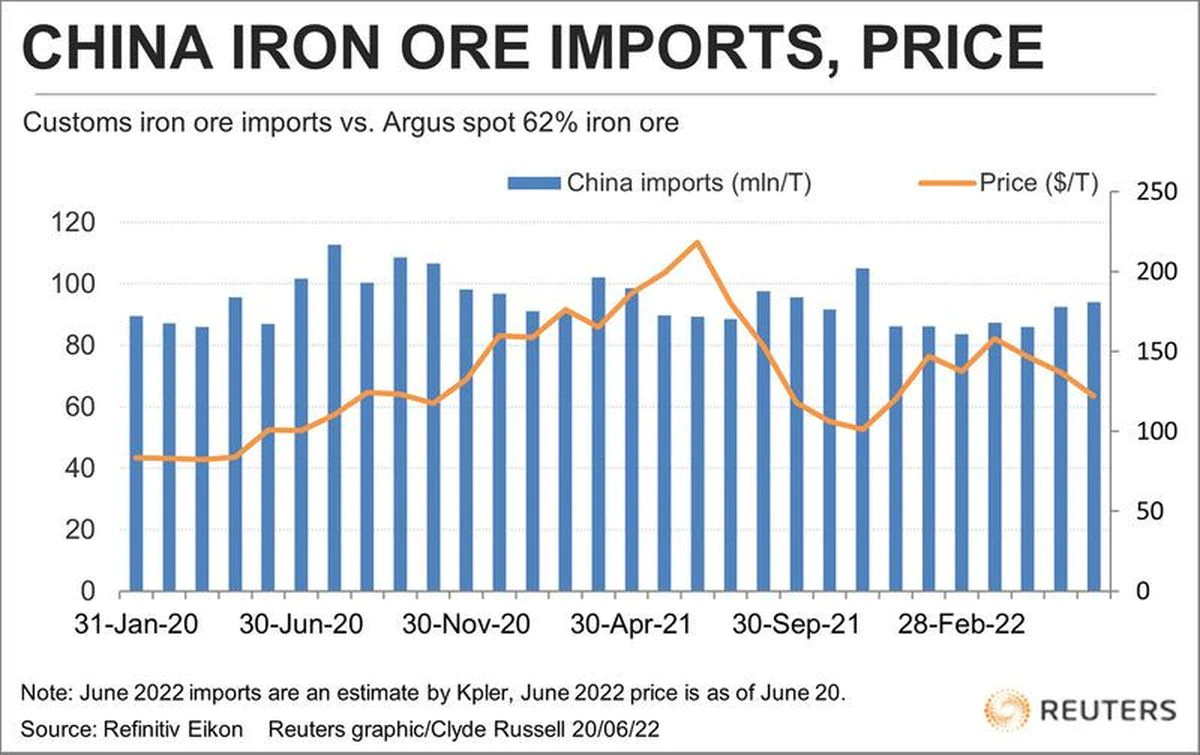

Reinforcing bars, a component frequently used in the construction sector, have seen their price decline by 20% since the beginning of May, placing pressure on business profitability. According to Peter Hannah, index manager at Fastmarkets, the profitability of Chinese steel mills is “very weak to negative right now.” There must be a price paid. Iron ore prices hit an all-time high of more than $230 a tonne a year ago as a result of a surge in demand following the end of the pandemic.

Prices dropped significantly in the second half of the year when Beijing ordered its sizable steel industry to cut production in an effort to cool the nation’s economy. The price of the commodity by the end of 2021 was $119 per pound. The Chinese government is concerned about this volatility and is taking action to consolidate the nation’s imports of iron ore by the end of this year through a new, centrally managed firm. The biggest suppliers to China are the Australian corporations BHP, Rio Tinto, and Fortescue Metals Group as well as the Brazilian company Vale. The question of whether Chinese steel production can continue at a rate of more than 1 billion tonnes annually “when margins are so compressed” is currently a topic of great worry.

Hamilton projected that iron ore will cost $100 per tonne “sooner rather than later.”

On the other side, other people had a happier outlook. The demand from communities emerging from Covid lockdowns and developers keen to achieve their half-year obligations made this week’s weekly data from the real estate sector the strongest so far this year. According to a US bank estimate, a sustained recovery in China’s real estate sector could lead to an increase in steel demand and iron ore prices in the second half of 2022.

JPMorgan analysts forecast that prices will be on average $140 per tonne in the third quarter of 2022 and $125 per tonne in the fourth. Since last December, prices for iron ore cargo with a 63.5 percent iron content for delivery to Tianjin have not fallen under $115 a tonne, as persistent coronavirus outbreaks in China and rash rate hikes harming the world economy have raised demand concerns.

Have the bears of the iron ore made a mistake here?

Things get even more difficult to predict when it comes to commodities. Even the most sophisticated “all-singing, all-dancing” supply-demand model has many flaws. A global epidemic, changes in government policy (especially in China), operational failures and disasters, weather and climatic factors, and other factors are all potential causes. Price prediction does, of course, include a certain amount of luck. Iron ore, a crucial raw material used in the manufacture of steel, has consistently been priced too low by analysts, consultants, industry experts, as well as some market participants.

Forecasts can, of course, be updated if new information or changing market conditions become available. But over the coming years, it is anticipated that iron ore prices would decline dramatically. More than a dozen analysts predict a drop in metal prices of between $5 and $10 per metric tonne during the following four years, with average prices of $95, $85, $85, $75, and $70 per metric tonne. Due to growing uncertainty on China’s demand projection, iron ore prices have decreased. The price of iron ore decreased by more than 8% on Monday as a result of growing skepticism regarding the demand projection in China. The average rate is 62 percent. Fe fines import costs into Northern China decreased by 8.18 percent to $111.69 per tonne as of December 17.

Since your writer started covering it in Shanghai in May 2008, the month of Fortescue Metals Group’s maiden shipment, the iron ore and steel industry has been telling him “Don’t get too excited right now; there will be a huge surplus in a few years. Millions of tonnes from Africa will flood the market, eventually replacing iron ore with scrap, and prices will drop to levels not seen in decades. On the day that this blog post was written, the S&P Global Platts IODEX 62 percent Fe benchmark was trading for $160.70/mt CFR China, a rise of 70% from the previous year. Price cuts are a fantasy.

Iron ore prices comprise Iron Ore Fine China Import

Iron ore prices comprise Iron Ore Fine China Import 63.5 Percent Grade Spot Cost and Freight, according to the Tianjin port of delivery. This substance is used to make steel for infrastructure and other building projects. China, Australia, and Brazil are the top three producers of iron ore, respectively. The other nations include South Africa, India, Russia, and Ukraine. The most actively traded iron ore contract for September delivery on the Chinese Dalian Commodity Exchange dropped 11% to 746 yuan ($111.60) per tonne, the lowest price since March 16.

In the mining industry, Rio Tinto and Fortescue both decreased from their highs from the previous week by 7% and 16%, respectively. China’s ferrous complex was impacted by “heavily curtailed, covid-affected domestic steel consumption,” according to to Navigate Commodities managing director Atilla Widnell of Singapore. Due to China’s strict zero-covid policy, which mandates that all citizens undergo routine coronavirus testing, several sectors of the country’s economy have suffered.

Mysteel noted in a different note that market confidence is still under strain due to weak downstream demand, a lack of spot transactions, and a bleak prognosis for China’s construction industry. Beijing has implemented a number of supportive policies in recent months, but no long-term price hikes have been noticed, and virus and Zero Covid regulatory risks continue to plague the industry.

In a letter, Rosealea Yao of Gavekal Dragonomics stated: “The conflict between excessive output and poor demand will have to be resolved with reduced pricing, major production cutbacks, or both unless the real estate industry launches a stronger rebound soon—which remains far from certain.