Admiral Little Box Reviews: Admiral is the brand name used by EUI Limited (Reg No: 02686904). EUI Limited is a member of the Admiral Group and is governed by the Financial Conduct Authority (FCA) (Firm reference number: 309378). To verify these facts, go to www.fca.org.uk/register. Other insurance companies are represented by EUI Limited. Admiral One, Admiral Loans, Admiral Money, and Admiral Car Finance are all owned by Admiral Financial Services Limited.

Admiral Financial Services Limited (Reg No: 10255225) is an FCA-regulated subsidiary of Admiral Group plc (Firm reference number: 771862).

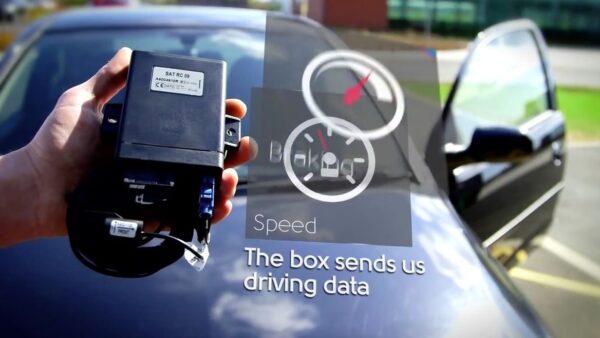

Is there a black box?

Telematics, or black box insurance, entails the installation of a small box in your vehicle. Braking and speed are both measured by this device. It enables you to demonstrate to your auto insurance company that you are a safe driver, which has an impact on the price of your renewal. Insurance for young drivers is expensive. Because new drivers file more claims, insurance companies charge them more. Annually, 17-22-year-olds spend more than £1,400. Young drivers’ premiums can be reduced with black box insurance.

What is black box insurance, and how does it work?

Black box insurance keeps track of your driving habits and adjusts your premium accordingly. Black boxes are installed by car insurance companies to track how you drive. Black box insurance is referred to as telematics. Your insurance premium will be updated monthly once it is installed. Safe-driving bonuses are offered by Drive Like a Girl and other insurers. You can drive more without increasing the cost of your car insurance. The policies of your insurer will differ. Some insurers place a higher value on certain driving behaviors than others, making each score subjective.

Measurements in the black box

Insurance with a black box:

- Overspeeding raises the cost of car insurance.

- Some insurance companies levy fines on speeders. Check your insurer’s website before purchasing coverage.

- Long drives raise the risk of an accident.

- Slamming on the brakes is risky. Car insurance will rise.

- Some road types are riskier. Your insurance rate may rise if you drive on less-safe surfaces.

- You should take a rest when driving. Your auto insurance rate will rise.

Black box insurance measures how long you drive and on what roads, so it’s not for everyone. If you have a long commute to work, even if you drive safely, you won’t obtain cheaper vehicle insurance with a black box.

Installing and removing a black box

Insurer-installed black boxes. One hour. Missing black box. It’s the size of a smartphone and nestled under the steering wheel. Canceling insurance deactivates the black box. Dormant black boxes may make your automobile harder to sell. Ask your insurer to remove it. Most charge, but not all. insurethebox doesn’t charge for black-box removal.

Black box testing

Your insurer’s app should show black box usage. Higher “scores” mean safer driving. Different insurers score differently. Direct Linescores from 1 to 100. Aviva Drive utilises 1-10 and Carrot 10-10. Admiral Littlebox’s dashboard provides extra recommendations and information with your score. Admiral’s black box dashboard. Before your premium is computed, tell your insurance if your usage data is false or unfair.

Black box rules

Each provider’s regulations should be posted online. Black box scores your driving based on:

- Speeding. Some insurers are harsher about speeding. If you often exceed the speed limit, several insurers will cancel your policy.

2. Drive time. Some black box insurance policies have nighttime driving curfews. Others don’t have curfews but decrease your score for night driving when most accidents happen.

3. Drive time. Avoid extended trips as much as possible to keep your insurance score high. Take pauses on long trips; your black box will thank you.

4. Driving surfaces. Some surfaces are accident-prone. Narrow, curving country roads are prone to car accidents. If you must drive on these surfaces, go slowly.

5. Your sudden braking. Black boxes record sudden brakes and quick bends. They mean you’re not leaving enough distance between you and other automobiles, lowering your score.

To Reduce Premiums:

- Drive safely

- Gradually brake

- Slowly turn

- Nighttime driving is dangerous.

- Keep curfew (if you have one) (if you have one)

- Regularly check usage

- Black-box speeding

- Some insurers will punish you for speeding unless you cause a catastrophic accident.

- Your insurer should cover driving overseas. Europe has greater speed limits than the UK.

- But it raises insurance premiums. Too many speeding tickets can cancel your insurance policy.

Black box insurance inexpensive

Your driving affects your black box insurance pricing. Most suppliers update monthly. Compare insurers’ basic pricing to find the best deal.

But the quote isn’t everything. Many black box insurers charge hidden fees at signup. If you:

- Installation

- Removal

- Box repairs

- Speeding

- Curfew-breaking

- Changing your car

- Affordable alternatives to black box insurance

Black box insurance isn’t the only way for new drivers to receive inexpensive auto insurance:

- Add a low-risk driver like a parent. It’s prohibited to list them as the main driver if it’s your car.

- Add extra security features. A safer automobile means cheaper insurance. Alarms make cars safer. Your car is safer in a garage than on the road.

- Spend more. The excess is extra money you agree to pay when filing a claim. Higher deductibles reduce insurance costs. Go as high as you can.

- Buy a cheap-to-insure automobile. Varied car “groups” have different insurance prices. In general, the faster and more powerful the car, the higher the insurance.

- Avoid automobile mods. Any alterations might raise your auto insurance by hundreds.

Endsleigh Insurance specializes in student and young driver automobile insurance without a black box. A broker can assist you to discover the greatest offer.

The black box will distract me when I’m Driving

No, it won’t. LittleBox is a small unit fitted out of sight behind your car’s dashboard. It isn’t like some driving apps that you have to activate before setting off, once it’s fitted you can forget it’s there and drive as normal. You won’t see the box again and you won’t hear a peep from it. Not at Admiral. As the policyholder only you will have access to the online dashboard that shows you when the car is driven. You can log in whenever you want and the dashboard won’t show the location of driving done, only the times of the journeys.

Cons of black box insurance

- New drivers get cheaper rates

- Safer driving

- Driving restrictions on where and when

- When insurance stops, several insurers charge to remove the box.

- Many hidden costs

- Unreliable insurers

- Incomplete data security

Black box readings are hard and time-consuming to challenge.

Admiral debunks or confirms myths:

- This policy is mere ‘Big Brother watching you raise rates.

- It’s actually the contrary. Behind the dashboard, Admiral LittleBox installs a little box. Admiral doesn’t track real-time location.

- Not where you drive, but how. It measures braking, cornering, and speed. Your renewal price depends on how safely you drive.

My driving style raises my insurance Premium

Your insurance provider can learn more about you through your driving habits. Good drivers can get premium discounts. I won’t know if I’m driving well. Admiral makes it easy to observe how you’re driving and get suggestions on how to drive safely and save money. If I speed, my insurer will notify the police. Admiral doesn’t tell cops if data reveals you speeded. Only a police probe or serious occurrence will prompt us to release data.