Point Home Equity Investment Reviews: Consider selling your home equity in the same manner that you might sell stock in a firm like Apple or Google. For everyone who buys a home and has equity in it, owning a home is considered the most valued asset in the United States. You may, for example, sell a piece of your home’s equity instead of getting a Mortgage. A “bridge loan” can be used to pay off high-interest debt or to cover the costs of buying a high-priced new property, as Point is doing.

One of the options Point offers is a home equity loan (HEI). This is an alternative to a HELOC that you should examine. Learn more about how it works and whether selling your home’s equity is something you should consider.

Is There a Purpose?

This California-based company has been in operation since 2014 and appears to be growing in size each year. This option provides an alternative approach to obtaining equity in your home. Traditionally, the only options were to refinance or take out a home equity line of credit (other than selling your house). You’ll be taking on extra debt with either of these options. To help with pressing financial needs, why not get a one-time payment equal to a proportion of the equity in your home? The point offers this service to homeowners who wish to tap into their home’s equity without taking on a considerable amount of debt.

California, Washington, Oregon, Colorado, New Jersey, Massachusetts, Virginia, Washington DC, Florida, New York, Maryland, Pennsylvania, Illinois, Michigan, Minnesota, Arizona, North Carolina, and Connecticut are among the states where Point currently operates. The point does not to become a co-owner of your home if you sell equity to them. Your decision to end the arrangement effectively turns them into co-owners in the appreciation of your home. They employ a Deed of Trust to guarantee their ownership of the property, much like a lender.

What are the Benefits to you?

You don’t have to pay back any of the money you borrow from your home’s equity if you use Point. You do, however, have the option of capping your investment before 30 years if you like. If the value of your house rises, the lump sum payment you got from Point, as well as a percentage of the current value, will be refunded to you (usually between 25-40 percent ). In the event that the value of your home drops, Point will share the loss with you.

Contracts with a Thirty-Year Duration

Yes, you must repay Point, but unlike traditional bank products, there are no continuous monthly costs to prevent you from receiving your funds. The Point HEI is normally regarded as complete at this point. You make the decision to sell your home. Your 30-year contract has finally come to an end. You have the option of returning your equity to Point at any time throughout the 30-year period. Alternatively, If you want to quit the Point HEI, the money you were given for the shares in your property, as well as a percentage of the gain in the value of your home, will be paid to Point. They may be able to generate money in the long run if they do it this way. A Fintech company like Point uses computers to forecast how much your home will increase in value over the next 30 years.

A risk adjustment is made in the case of a loss

When compared to Point’s competitors, such as Unison or Hometap, the assessed value of your home will be reduced by 15% to 20% right away. A “risk adjustment” is a reduction in the value of your home in the event that it decreases in value. Actually, this risk-adjustment strategy isn’t one of our favorites. The point has a high chance of profiting on its investment in your home because home values tend to rise over time. In addition, Point reduces the initial value of your home to 75-80% of its appraised value, making it even more appealing to the firm.

Investing in Rental Properties

Home equity sharing firms, for the most part, only invest in properties that are occupied by the owner. Point is an exception to the norm because you don’t have to live in a house. Rental homes have a “Rental Premium,” which can be substantial but is well worth it in the long term. According to Point, this premium is approximately 10% of the company’s typical appreciation share. It’s worth remembering that if Point gets 30% of the value of an owner-occupied home, it gets 33% of the growth of the same property when it’s rented out.

Is there a charge to use this site? If so, what is it?

There are a few fees associated with Point. You will be charged for the appraiser’s visit to your home. You should expect to pay between $500 and $820 for this. A transaction fee of between 3% and 5% is also charged by Point. The homeowner will not be responsible for any of these costs upfront. Before the funds are transmitted to your bank account, they will be deducted from the wire. When it comes time to settle your investment, Point will charge you a $45 Reconveyance Service Fee and a $30 Payoff Demand Statement.

What other measures does Point compare to?

In comparison to its opponents, Point has two distinct advantages. First and foremost, it gives purchasers a 30-year window to repay their debts. Home tap investments, on the other hand, must be returned within ten years for Unison to accept them. The point will first and principally invest in rental properties. At this time, Unison and Hometap are unlikely to support this. If you need to access the equity in your home, an investment property will require you to give up a larger percentage of the appreciation, but it may still be a reasonable option. Despite these benefits, Point’s risk adjustments constitute a significant disadvantage. Unless you own rental property, Hometap or Unison are usually better solutions.

Why immediately give away 15% to 20% of your home’s appraised value if you don’t have to?

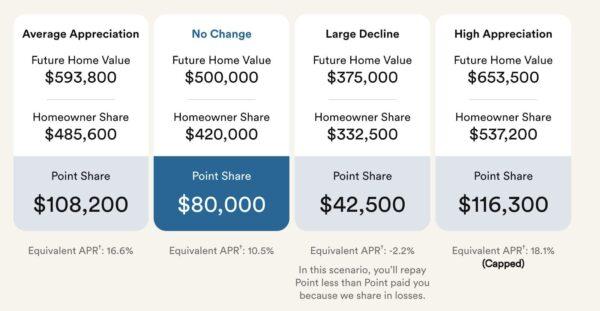

Other costs and fees must be considered in addition to the prices and fees already mentioned. In order to evaluate the merits of a recommendation, a number of variables must be considered, some of which are unknown. The home’s worth in the previous image declined by 0% over a five-year period. Here’s what occurs if the average appreciation rate, the value fall, and the high appreciation rate are all varied over the period of five years. This graph clearly shows that the higher the value of your home, the more expensive it will be to insure it. It’s crucial to remember that as a result of this, the value of your home is increasing. Let’s take a look at your contract with Point in the short term. Let’s say you decide to end the contract after a year.

In this situation, the wide range of outcomes is Significant

If the value of your home had dropped drastically, the appropriate APR would be -11 percent. A high rate of appreciation, on the other hand, would result in an APR of 22.3 percent. A 25-year contract with Point exemplifies the opposite end of the spectrum. In this scenario, the range of probable outcomes is smaller. The worst-case situation is paying 9.5 percent APR for 30 years (and 0.4 percent in a best-case scenario).

Point deducts processing and appraisal fees from your earnings, as well as charges additional fees for various services. Managing default events for owners ($500-$3,500): These are the fees you’ll have to pay if you don’t satisfy your financial obligations. You may be compelled to pay for another examination, which can cost anywhere from $500 to $820, depending on how you repay Point. $ 30: The cost of preparing a payment demand statement, which asks the company to reveal certain parameters of an early acquisition.

You must pay the Reconveyance Service Fee ($45) to compensate Point for the costs of producing the documents and releasing them from its portion of your property. Subordination charge of $250 for acknowledging in writing that you are junior to other parties with an interest in the property (such as lenders). Expenses associated with adding or removing a homeowner from the property’s title ($250).