Palantir Stock Earnings: Palantir Technologies Inc. is scheduled to release earnings before the market opens on Tuesday, February 17th, 2022. The financial quarter that ends in December 2021 will be the subject of the report. As of this writing, Zacks Investment Research estimates that the company’s EPS for the quarter is expected to be $0.04. For the same period the previous year, the company had an EPS of $0.07.

Palantir’s sales surpassed forecasts, but its profitability missed them by a considerable margin. This last quarter saw Palantir Technologies Inc. (PLTR) grow sales faster than expected, while earnings per share fell short of forecasts. A loss of $156.2 million, or 8 cents per share, was disclosed by the software business on Thursday compared to a loss of $148.3 million, or 8 cents per share, in the year-ago quarter. A year ago, Palantir made 3 cents per share after accounting for stock-based compensation and other costs. FactSet analysts’ consensus estimate was for the company to make 2 cents per share. Analysts polled by FactSet expected Palantir’s revenue to rise to $418 million from $322.1 million, but the company actually made $432.9 million.

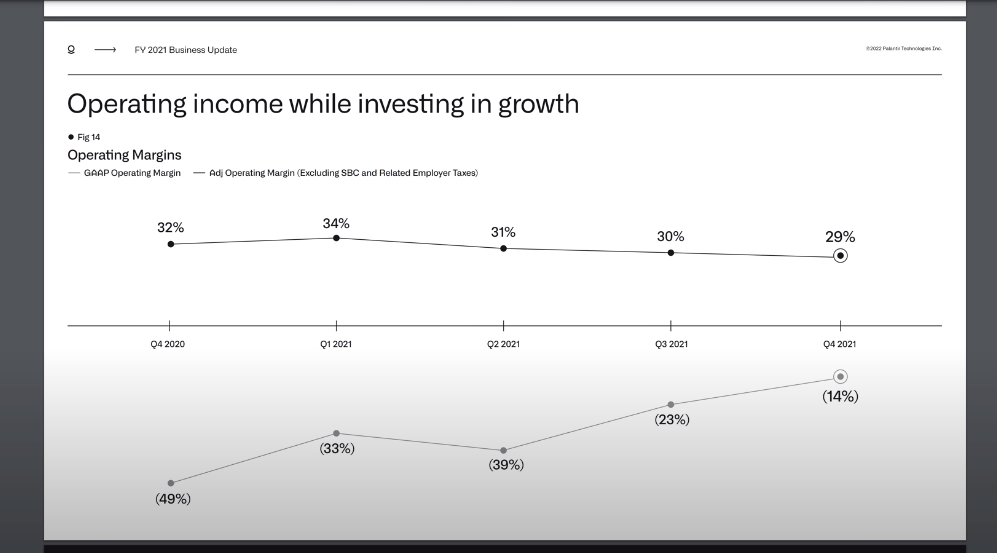

A rise of 47 percent in commercial income and 26 percent in government revenue were reported by the corporation. During the fourth quarter, Palantir gained 34 new net clients. There was a FactSet average estimate of $439 million in revenue for the first quarter, but the business is forecasting $443 million. An adjusted operating margin of 23% for the first quarter, and 27% for the entire year, is forecasted. During the previous three months, Palantir’s stock has fallen 40%, while the S&P 500 has dropped 5%.

Predictor of Future Price Swings

Analyst mood changes over time, and this might be a predictor of future price swings, as measured by Estimate Momentum. The Change in Consensus chart displays the current, one week ago, and one month ago EPS* expectations. The consensus EPS* prediction for the fiscal quarter ending Dec 2021 has maintained at 0.04 for the past week and at 0.04 for the past month. None of the forecasters raised or decreased their predictions. The consensus EPS* prediction for the fiscal year ending December 2021 has remained the same over the last week at -0.07 and has been the same over the past month at -0.07.

None of the forecasters raised or decreased their predictions. the consensus estimate of $0.04 per share for Palantir Technologies Inc. (PLTR) was missed by a penny. A year ago, the company earned $0.07 per share. Non-recurring elements have been removed from these calculations. This quarterly report shows a -50 percent drop in earnings. A quarter ago, this firm was projected to make earnings of $0.03 per share, but it actually produced earnings of $0.04, a surprise of 33.33 percent. The fact that Palantir missed expectations in the fourth quarter may have the bears on the prowl, but it shouldn’t detract from the company’s improving fundamentals or its promising long-term growth potential.

With a three-year-old, Palantir’s stock might be a wise investment that pays off handsomely in the long run. In this post, the author expresses his or her own views, which may conflict with those of a Motley Fool premium service. We’re a mishmash! Even if it’s our own, we can all benefit from questioning an investment thesis and making better, happier, and wealthier decisions. Since the beginning of the year, Palantir Technologies Inc. shares have been down 23.3 percent, compared to the S&P 500’s decrease of 6.1 percent.

Only once in the past four quarters has the firm exceeded the consensus EPS projection. “

As a member of the Zacks Technology Services category, Palantir Technologies Inc. recently reported sales of $432.87 million for the three months ending December 2021, a 3.53 percent increase above the consensus estimate. This is in contrast to revenue of $322.09 million in the prior year. Over the past four quarters, the firm has surpassed revenue expectations on four separate occasions. There will be a big impact on the stock’s long-term value if management’s comments on the results call to have a positive effect.

For Palantir Technologies, Inc., what’s the future?

This year has seen Palantir Technologies Inc. underperform the market as a whole, but what is the company’s future? This is a difficult issue to answer, but investors may use the company’s profits projection as a solid guide. For the coming quarters, this includes current consensus earnings forecasts, as well as how these predictions have evolved recently. (https://acatimes.com/)

Near-term market fluctuations and changes in profit forecasts are strongly linked, according to empirical evidence. These changes may be tracked by investors directly or via the use of an established grading tool like the Zacks Rank, which has a proven track record of capitalizing on the impact that modifications to earnings estimates can have. The estimate revisions trend for Palantir Technologies Inc. is favorable ahead of this earnings announcement. Zacks has the stock rated as a “Buy” despite the fact that the amount and direction of estimate adjustments might alter in the wake of the company’s recent earnings report. There are many reasons to believe that stock prices will continue to rise. See the full list of Zacks #1 Rank (Strong Buy) stocks for today by clicking here.

This quarter’s and the current fiscal year’s forecasts will be intriguing to watch. On $439.91 million in revenue, EPS is expected to be $0.05, and on $1.95 billion in revenue, it is expected to be $0.22. Market conditions can have a significant influence on stock performance, so investors should keep this in mind. As of now, the Zacks Industry Rank for Technology Services is in the bottom 38 percent of the more than 250 Zacks Industries. Over a two-to-one ratio, we found that the top half of the Zacks-ranked industries outperformed the bottom half.

For the quarter ending December 2021, GDS Holdings (GDS), a stock in the same industry, has yet to release its financial results. Year over year, the predicted loss per share for this firm is expected to be -3.9 percent at $0.27, according to the company’s next report. This quarter’s EPS estimate has been lowered by 17 percent in the past 30 days. According to estimates, GDS Holdings’ revenues would rise by 33.1 percent to $332.84 million in the third quarter of 2013.

Is Palantir’s Q4 Earnings Miss a Concern for Investors?

Analysts weren’t impressed by the company’s earnings last quarter, even though revenue increased significantly. Points to Remember

- Net losses at Palantir have not decreased despite the company’s increased sales.

- The company, on the other hand, is in excellent financial health.

- Palantir’s revenue growth is expected to remain at 30% each year.

As Palantir Technologies (NYSE: PLTR) posted an earnings result that fell short of analyst forecasts, its shares plunged more than 10% today. Known for its data analytics and counterterrorism technologies, Palantir is used by numerous government agencies. There is a return to the stock’s 52-week lows. For investors who are looking to take advantage of the stock’s recent earnings miss, is this a good chance for growth?

They appear worse than they are because of rising net losses

Palantir announced fourth-quarter sales of $432.9 million, an increase of 34% over the same period last year. Also, its net loss of $156.2 million climbed by more than 5 percent. While the company’s top line continues to improve, investors are likely more concerned about its bottom line, which may be the reason for the bearishness, as its adjusted per-share profit of $0.02 was below the $0.04 that analysts were looking for in Q4 (revenue, on the other hand, outperformed as analysts were projecting only $418 million for the top line).

Does this mean this is the best time to get in on the action?

The last time Palantir’s stock was trading at a lower level than it is currently was in November 2020. As a result, the company has flourished, attracting new clients and becoming a far more reliable investment. Today, the company restated its aim of at least 30 percent annual sales growth until 2025, indicating that the business is currently proceeding according to plan.