Mr. Cooper, a prominent provider of mortgages and loans, has unexpectedly become embroiled in a cybersecurity storm. On October 31, 2023, the organization was forced to promptly respond to a cyberattack in order to safeguard its systems and customer information; as a result, a continuous system outage ensued. With 4.1 million customers, this incident exposed significant concerns regarding customer trust and data security for one of the largest mortgage lenders in the country. This article provides a comprehensive analysis of the Mr. Cooper cybersecurity breach, examining its potential ramifications for both clients and the financial sector.

Key Points:

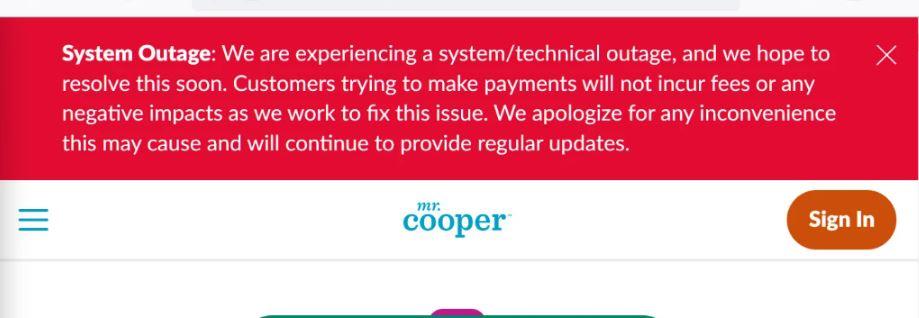

- Cybersecurity Incident Disrupts Operations: The Mr. Cooper cybersecurity incident occurred on October 31, 2023, leading to an immediate system lockdown to safeguard customer data. As of now, the IT systems remain inaccessible, causing operational disruptions for millions of customers. The incident marks another reminder of the evolving threat landscape facing financial institutions.

- Ongoing Investigation: In response to the breach, Mr. Cooper initiated incident response protocols and deployed containment measures to protect systems and data. The company is actively investigating the extent of the breach and whether any customer data has been exposed. Transparency and communication with affected customers are essential aspects of managing the aftermath.

- Customer Reassurance: Mr. Cooper has taken steps to reassure its customers by promising not to charge late fees, penalties, or negative credit reporting for those unable to make timely payments due to the system outage. While this commitment offers relief, the breach emphasizes the importance of enhancing security measures to prevent such incidents.

- Ransomware Suspicions: While the nature of the attack remains undisclosed, several signs point to ransomware as a potential cause. If this proves true, the cybercriminals may use stolen data as leverage to demand a ransom from Mr. Cooper. Customers must remain vigilant against potential phishing attacks and identity theft.

- Implications for Data Security and Trust: The breach not only jeopardizes the personal data of millions of customers but also has wider implications for trust in digital financial transactions. As a trusted financial services provider, Mr. Cooper’s response to the breach and future security measures will significantly influence customer trust in the industry.

FAQs:

- What caused the Mr. Cooper cybersecurity breach?

- The breach was initiated by a cyberattack on October 31, 2023. The nature of the attack is still under investigation.

- How is Mr. Cooper addressing the issue for affected customers?

- Mr. Cooper has committed not to charge late fees, penalties, or negative credit reporting for customers facing difficulties due to the system outage.

- What are the potential consequences of this breach for customers?

- Customers should remain vigilant against potential phishing attacks and identity theft, especially if the breach involves stolen data.

- What does this incident mean for data security in the financial industry?

- The Mr. Cooper breach highlights the critical need for robust cybersecurity measures in the rapidly expanding digital financial landscape.

- How might this breach affect trust in digital financial transactions?

- The incident could impact customer confidence in digital financial transactions, ranging from identity theft to financial fraud.