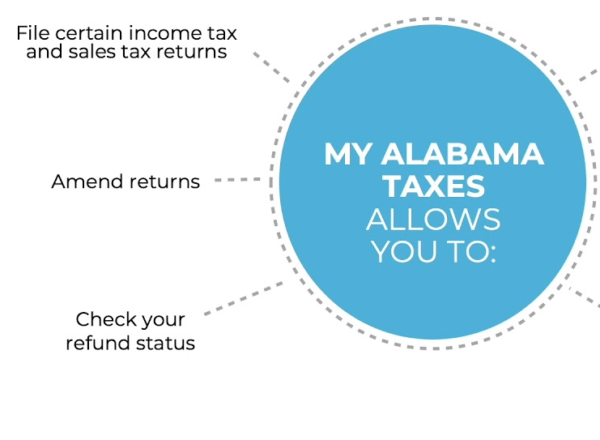

Https //Myalabamataxes.alabama.gov Verify My Return: Increased security measures have been put in place by the Alabama Department of Revenue to prevent identity theft and fraud. For ID Confirmation Quiz Participants, this page is the place to go for answers. In an effort to protect your identity and your tax refund, the IRS has developed a five-minute ID verification quiz.

What happened to my reimbursement – AL?

We will proceed with the processing of your tax return when you have finished the questionnaire and verified your identification. Visit https://myalabamataxes.alabama.gov/?link=refund to see if your Alabama state refund has been processed. Each year, refunds will begin being distributed on March 1st. After this date, you can check the status of your reimbursement here. Due to the complexity of the return and Alabama’s identification verification requirements, return processing times can vary widely. Please allow up to a month for your refund to arrive.

- Input your Social Security Number here.

- where and when it was submitted, as well as how long ago

- Then click the “Search” button and enter your projected refund amount.

- Call 855-894-7391 for the most up-to-date information on the status of your return for the current tax year.-year.

In what ways might my Alabama refund be delayed?

Mistakes in your tax return, such as incorrect or missing numbers. You completed your tax return by filling out many forms. Incomplete or missing information was found in your submission. Some results may be delayed because of fraud and mistake controls. Contact the Alabama Department of Revenue for additional tax and refund information. You may find out more about the Alabama Department of Revenue at www.revenue.alabama.gov.

Additional information about tax matters?

H&R Block is here to help you file your taxes, whether you choose to meet with one of our tax experts or use one of our online tax filing services. Do you want to know if your federal refund has been processed? To find out when you’ll receive your federal return, go to our Where’s My Refund website. You can choose from a variety of tax returns in Alabama to assist you to pay sales tax to the state. The Simplified Sellers Use Tax Return, a return widely used by out-of-state sellers, is explained in this blog post.

A Step-by-Step Guide to Login to Alabama’s Tax Return Website

The first step is to walk you through the process of logging into the website to complete your Alabama sales tax return. Begin by visiting https://myalabamataxes.gov/ / (My Alabama Tax Exemption System).

Step 2: Enter your username and password to access your account. The first thing you should do is create a username and password. When you apply for a sales tax permit, your username and password are often generated. TaxValet offers a Sales Tax Permit Registration Service if you don’t want to deal with securing a permit or a state login on your own.

Step 3: You’ll be taken to your dashboard for that particular state. If you have any unread messages, this is a good moment to check the Alerts banner. Return submission and payment submission notifications are two of the most common reasons for receiving these messages. Even so, it’s a good idea to check these regularly out of an abundance of caution.

The next step is to glance at the center of the viewing window. Find “Accounts” in the menu and then choose the right account to file your tax return for you. Identifying the problem is as simple as calling Alabama at (334) 242-1490 if you don’t see an account listed under this tab. If you’ve completed the account setup process, it’s usually a straightforward technical repair.

You will see a new banner like this after logging into your account in Step 5. You should be able to see both prior returns you’ve submitted and the current return due under “Periods.” Clearly, this company must file sales tax reports on a monthly basis.

The next step is to choose a time period. The next step is to locate “I Want To” in the screen’s upper right corner. This is what it should look like: Make a return by clicking on the “File or View” option.

Step 7: Select “File a return” from the “I want to” drop-down menu. Input your information for this filing period by clicking on this link. A Risk Management Guide for State Audits is available for free. Find out which states are the most dangerous for your company.

Audit Risk Percentages by State

“PLUS: Amounts Over-collected” is the next row up. It doesn’t matter whether or not you owe tax on money collected in the reporting period; if you did, you must remit it. Sales tax must be paid in full to the state if a business collects it and does not do so. “PLUS: Over-collected” is where this discrepancy needs to be accounted for if any. You should only use the second “LESS: Credit Claimed” line if you need to account for a previous period of overpayment.

How to Comply with the Sales Tax Laws in Alabama

The “Next” button will appear after you have confirmed that all data is correct. Upon your return, you will be given a summary of your expenses. You must submit your return and pay electronically. Make sure to make the payment on time, if not before the due date.

No one wants to be charged late fees!

Be careful to keep all of your receipts and paperwork once you’ve processed your refund and made your payment. Please take a moment to celebrate your accomplishments. Finally, you’ve completed and submitted your Alabama sales tax form. Verify that the correct amount of money was taken out of your bank account on the correct day as the last step.

After Filing an Alabama Sales Tax Return, What Should You Do?

Don’t stress if you neglected to save or print a copy of your sales tax return. View and print your tax return at any time by going back in time. It’s as simple as returning to your dashboard, selecting the period you want to view, and clicking “File or view a return” under “I Want To.” To view or print the return you just submitted, click “I Want To” in the upper right corner of the screen from this page.

Filing an Alabama Sales Tax Return

Please call (334) 242-1490 between 8:00 A.M and 5:00 P.M CST to speak with the state of Alabama directly if you have any questions or concerns. Alabama’s Department of Revenue (DOR) website has extra information, as well, at https://myalabamataxes.alabama.gov/. However, our Done-for-You Sales Tax Service is a good option if you want a team of tax experts to handle your sales tax returns on a monthly basis. If you’re interested in working with us, please don’t hesitate to get in touch with us.

Do You Have to Pay Alabama’s Sales and Use Tax?

Sales tax returns must be filed in Alabama once a sales tax permit is active. In Alabama, are you unsure if you need a permit? No worries. For further information, see Do you need a sales tax permit in Alabama? on our website. TaxValet’s Done-for-You Sales Tax Service may take care of your Alabama filings if you prefer to delegate that responsibility to us. Sales tax is one of the most frustrating and time-consuming aspects of doing business.