How To Contribute To Rrsp Without Cash: (Make an in-kind donation) Finally, if you have other investments outside of your RRSP, consider making an in-kind contribution. Do this by moving some of your non-RRSP investments into your RRSP. The money you transfer to your RRSP qualifies as a tax Deduction. Make sure you have enough room in your RRSP for this before you proceed.

With the help of the RRSP Home Buyer’s Plan, you can buy a home with your RRSP contributions. Yes, I am a first-time purchaser. Withdrawing money from your RRSP can be used to buy your first home. What options do you have if you’re a first-time home buyer? The maximum amount you and your spouse can borrow from your RRSP to buy your first home is $35,000 each. Suppose Melissa wants to buy a house in five years, as an example. She intends to save $20,000 for a down payment by setting aside $300 each month for that purpose.

What happens if Melissa contributes $300 per month ($3,600 annually) to an RRSP? What happens? assuming she has room in her budget for that. Based on her marginal tax rate, she will save 30%. This equates to an annual tax refund of $1,080. Melissa will be able to borrow $20,000 from her RRSP when she turns thirty-five years old. In addition, tax savings of $6,000 will be available to her.

The Home Buyers’ Plan allows you to borrow money from your RRSP. Over the course of 15 years, you must return the money to your RRSP. It is necessary for Melissa to set aside $1,333.33 annually for a period of 15 years. She will lose out on the tax-advantaged growth of that $20,000 in the future. So, Melissa may want to consider using funds in an unregistered account first. With the help of the RRSP Lifelong Learning Plan, you can go back to school.

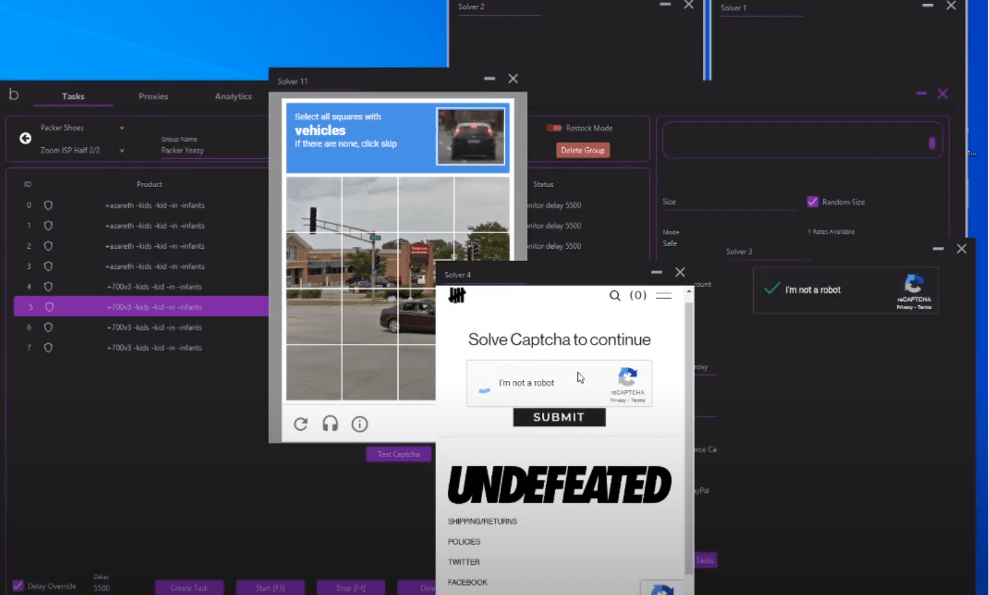

A step-by-step explanation of the process:

The Lifelong Learning Plan allows you to use an RRSP to pay for your own or your spouse’s education (LLP). What is the LLP for? The LLP allows you to make tax-free withdrawals from your RRSP of up to $10,000 per year, up to a total of $20,000. A full-time education program can then be paid for with that money. If either of you has a disability, you can use this as a part-time program. Withdrawals for training or education are tax-free, just like with the Home Buyer’s Plan. If you fill out the government form RC96, you’ll be able to do this. Suppose Zoe, for example, decides to go back to school for two years to get a master’s degree. She decides to take out a two-year RRSP loan for the maximum amount of $10,000 per year.

As a result, she owes a total of $20,000 back to the bank. Over the course of 10 years, she must pay back her RRSP at the rate of $2,000. If she doesn’t make her yearly payment, what happens? After that, the money will be deducted from her yearly salary. And she’ll be taxed at her marginal rate of income taxation. Because it was in her plan, she would have been able to earn tax-sheltered growth.

Are you saving enough in your RRSP? Is there anything

Consider one of these three options to get your RRSPs in order:

With this RRSP calculator, you can see if you’re saving enough: You can check your RRSP balance or make a contribution by logging into your mysunlife.ca account if you have a Sun Life workplace savings plan. There may be room for additional contributions (if there is unused space).

RRSPs are a great way to save for the future. Or, on the other hand, do you prefer to save more money? Let us lead the way. Savings plans can be tailored to suit your individual needs by an advisor from Sun Life. Make an appointment with a professional who can help you. You have until March 1, 2022, to contribute to your RRSP.

Use a spousal RRSP to divide your income.

To save money on taxes, you should consider splitting RRSP earnings with your spouse (or partner-in-crime). Using an RRSP, you can do this in two ways. (ambien) You can begin by contributing to a spousal RRSP. Let’s say, for example, that

Jack has a $10,000 annual RRSP cap. he can either be attributed to:

- his own Individual Retirement Account (IRA).

- His wife, Jenna, is the annuitant of a spousal RRSP to which he contributes.*

- In the case of a pension or investment, an annuitant is a person who is entitled to receive payments on a regular basis.

RRSP contributions made by a spouse are subject to taxation. He’ll get a higher tax deduction than Jenna would if she contributed to her own retirement plan. In retirement, they can withdraw from their own RRSPs to pay for their expenses. This means that Jack will owe less tax in the long run. According to his current tax bracket, this amount is less than it would have been at his higher tax rate. After three years, Jenna must withdraw from the spousal retirement savings plan (RRSP). If she doesn’t, Jack will be on the hook for the taxes on Jenna’s withdrawals.

At the age of 65 or later, you have the option of splitting your RRSP income in half. Let’s pretend Mark is 72 years old now. His registered retirement income fund (RRIF) is now generating income from his RRSP. The government considers any RRIF income eligible pension income for those 65 years of age and older. If you’re married, you have the option of dividing your income 50/50. Mark’s income tax bill can be reduced if Mark’s spouse is in a lower tax bracket. How? With the option of giving his spouse up to half of that income, but not necessarily the RRIF itself.

Make RRSP contributions in the form of goods and services

Many people contribute to their RRSPs by depositing cash into their accounts. Nonetheless, cash donations aren’t the only option available to you. There are a number of ways to transfer assets from a non-registered investment account to an RRSP, such as Jacob transferring bonds, mutual funds, or stocks in kind (or “as is”). (Be sure to check your RRSP rules; this strategy may not be allowed by all plans.)

When you transfer stocks or bonds into an RRSP, what will happen? You still have to pay taxes on it. It’s possible to realize capital gains when making an in-kind contribution to an RRSP (even if the shares are transferred directly). A “deemed disposition at fair market value” has occurred even if you haven’t sold the shares on the market. As a result, if the value of your investment has increased, you may have to pay capital gains tax.

What happens if you spend more than $2,000 of your contingency?

You’ll be penalized 1% per month until the excess is withdrawn. To maximize your RRSP, you can employ any of these strategies. Alternatively, you can simply continue saving for your golden years. Keep in mind that the most important thing you can do is start saving right away and make it a regular part of your life.

Top-up loan

If you’ve been contributing to your RRSP but still have unused contribution room, consider a top-up loan that can allow you to contribute more this year than you might otherwise. Now, when it comes to borrowing to contribute to your RRSP, you can’t deduct the interest cost, so you’ll want to pay off that loan quickly. Let me show you some math here