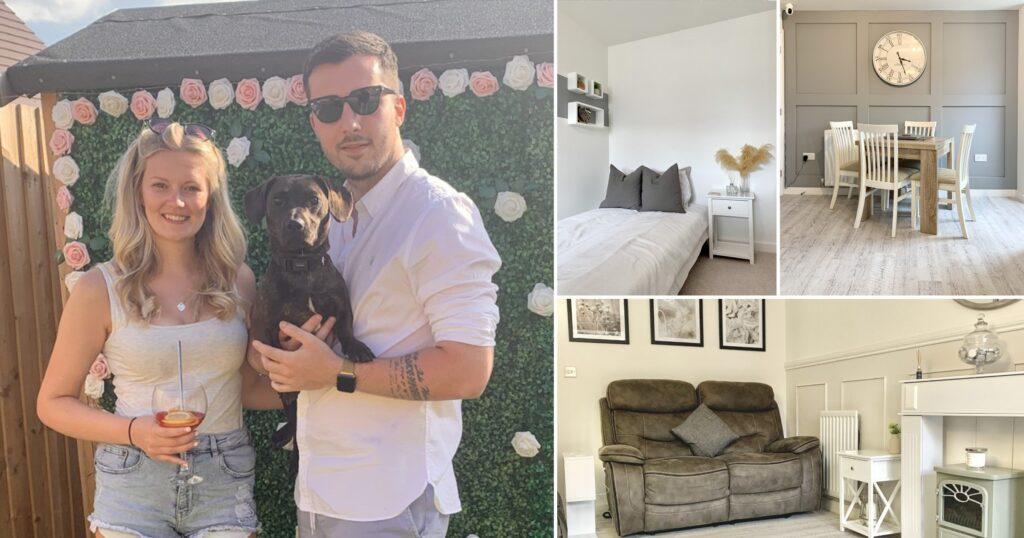

How To Buy A House On 16K Salary: SCRIMPER First-time buyer saved £16k by batch-cooking, abandoning the gym, and taking surveys. Luke Beasley saved $16,000 by eating for £15 a week, canceling subscriptions, and taking online surveys. The 30-year-old bought a two-bedroom Bristol terrace for £235,000. Luke saved the money in 18 months while working for Milner Foundations. He paid his parents £50 a week rent while living with them, but in his late 20s chose to move out.

He saved up to £300 a week to prepare for the rental market before realizing he could afford shared ownership. He saved money by limiting his food budget to £15 a week and batch cooking pasta and tomato sauce. He abandoned the gym to save £24 a month and stopped Netflix to save half his weekly wage. Luke made $25 to $50 a month taking online surveys. Now he owns 50 percent of his home and pays £490 a month on his mortgage and £143 a month in rent and service charges. Luke moved into a new home for My First Home.

Your home?

Like other residences on the estate, mine has a wheelchair-accessible hallway through the front door. It’s not anything I specifically wanted in a home, but how it’s designed. Another big toilet is downstairs. As there is no dining room, I have a folding table in the back kitchen, which connects to the yard. From my room, I can see the Mendip Hills 15 kilometers distant. At my parents’ house, parking was on the street, so I was usually fighting for a spot. This up-and-coming location is familiar to me. I know where all the neighborhood pubs and shops are. I can drive 20 to 30 minutes to work and 10 minutes to Bristol’s city center.

Why a shared ownership property?

I never felt compelled to leave my parent’s home because I never went to college and work for the family business. In March 2018, I started saving for moving out and paying rent. I decided to buy it after a few months. As a single buyer, I couldn’t afford Bristol. My step-brother suggested a Help to Buy loan, but shared ownership seemed more realistic because I wouldn’t need a second loan. It’s a stepping stone; in five years I may sell it and go full-time, or I can staircase anytime I want. My postcode has Bristol’s fastest-rising house values, so I’m hopeful I’ll make money when I sell. But my prices are still £200 to £300 cheaper than renting a similar property.

Shared ownership finances:

I own 50 percent of the property and required 5 percent down. The house originally cost £250,000, thus a half-share deposit was £6,250. Leeds Building Society downvalued the property to $235,000 when I bought a mortgage. They didn’t think the property was worth what I was paying, so they wouldn’t lend me the money. Luckily, the housing association was prepared to drop the value to what the lender thought it was worth, so I didn’t lose it. My half earned £117,500. I put down £6,500, 5 percent. To fund the rest of my portion, I borrowed £111,000. It was under £300,000, so I didn’t have to pay stamp duty.

How was the deposit saved?

When I bought my house 17 months after I started saving, I had £16,000. I’m weekly paid, so I started saving $200 to $300 a week. Because you can only save £400 a month in a Help to Buy ISA, I put the money in a standard savings account. Saving changed my life. When I started saving money, I bought my own food and set a £15 weekly budget. I ate noodles and canned tomato sauce. I bought frozen chicken for £3 and noodles for 29p at Asda and made it stretch. I bought frozen herbs and dried foods. One packet of spaghetti lasted a week, including meals. Instead of ordering takeout, I’d buy curry ingredients and make enough for three nights.

How much have you spent?

After moving here, I spent £3,000 on flooring. The house came with an oven, hood, and hob, and I spent $1,900 on a fridge, washer, freezer, and dryer. I have £2,000 saved for a rainy day and am continuing to save; last month I saved £350 although the amount varies. Netflix, Amazon, and Now TV are cheaper than Sky when I moved in.

How did keys feel?

It was great, but mostly relief. Due to the down valuation, my transfer was delayed and rough. It’s good to own a home with equity. In addition to this, I had an accessible savings account into which I made regular contributions of as much money as I could. My savings fluctuated from month to month, ranging from as little as £200 to as much as £1,000 (I didn’t stop my life to save; I’ve always gone on luxurious vacations and never said no to a night out).

How would you advise others about joint ownership?

Shared ownership is unpopular, therefore you must be flexible. Be open-minded and research constraints.

How did you come up with the initial down payment?

I’ve always been an excellent saver, going back to the age of 16 when I started working. As soon as they were available, I opened a Help to Buy Individual Savings Account (HISA) (HISA). I put in the maximum of £200 a month as a standing order after opening it with £1,000 of my own money. By the time I came to buy I had the maximum in there, which is £12,000, which meant that I got the government bonus of £3,000.

What was it like for you to obtain a Mortgage?

Waiting until my Help to Buy ISA was nearly full before seeking advice was a mistake on my part. I was afraid to buy a house because I thought you needed a large down payment, so I put it off. There are people who have put as little as £5,000 down on a shared ownership home that I’ve spoken to recently. While it’s true that I could have done this all sooner, having an extra £10,000 in savings after moving in and a larger deposit with lower monthly payments made it worth the wait.

What made you want to buy rather than rent?

I really didn’t want to ever rent because I don’t think I’d have ever been able to get out of that cycle. I know a lot of people that rent, who aren’t able to save much and will really struggle to ever buy a house. It’s more expensive to rent a small flat in Chippenham than what I pay for my beautiful two-bed house.

How did you find this property? What made you choose it?

I always look on Rightmove (I mean, who doesn’t?) I am always on there looking at million-pound houses thinking about how I’d decorate them. But I always kept my eye on two-bedroom houses there. I originally reserved a new build flat in Chippenham as, after speaking to a few mortgage brokers, they got it into my head that that was all I was ever going to be able to afford alone. However, I wasn’t settled on this as I absolutely knew I’d hate having no garden.

How have you made the property feel at home?

It’s not just me here, my boyfriend Zach lives with me and we now have a puppy called Dougie. Zach decided to go back into education and is studying at Reading University, which has meant he’s no longer on a full-time salary so couldn’t get the mortgage with me. We decided that rather than him still renting and me living at home for a few more years that it’s best for me to get onto the property ladder through shared ownership with the plan to buy together in a few years’ time.