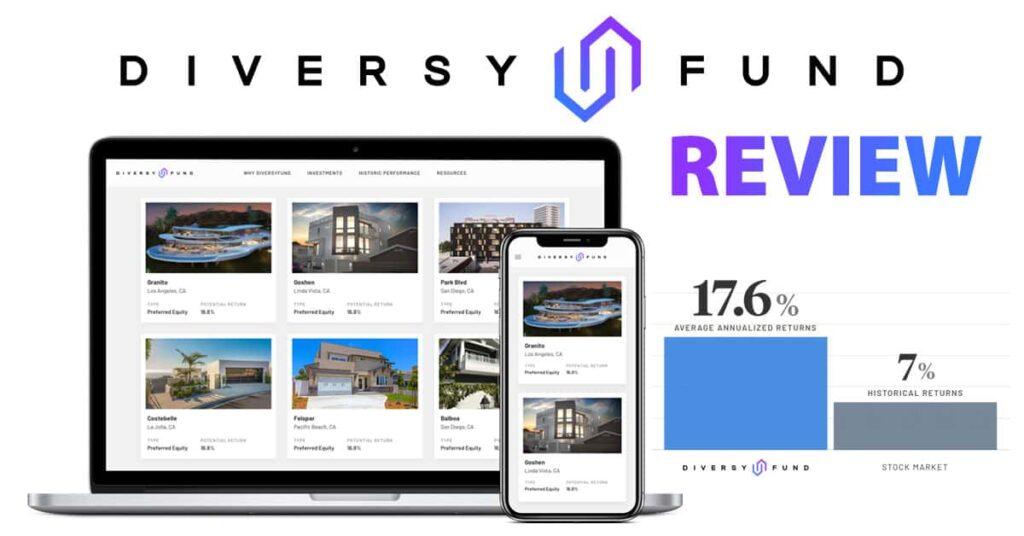

Diversyfund Reviews: DiversyFund, which launched in 2014, is an online real estate investing Platform that allows investors with less than $1 million to invest in private commercial real estate transactions. Unlike some other sites, DiversyFund takes care of everything for you. Investopedia claims it wants to assist those who don’t have millions of dollars but yet want to make a difference in the investing industry.

DiversyFund requires investors to commit to a minimum of a five-year term in order to achieve the best possible returns. You won’t be able to withdraw money from your account for at least five years after you’ve opened it. DiversyFund has apps for both iOS and Android. Continue reading to see how it stacks up against other investment platforms.

So, how do we stack up against DiversyFund?

Fundraise allows accredited and non-accredited investors to invest in real estate. Despite the fact that both platforms demand a $500 minimum investment, the fees and investment options available on each site differ. DiversyFund is the only means to participate in REITs, however, Fundrise also offers electronic real estate funds, initial public offerings, and self-directed IRAs. Yieldstreet, on the other hand, specializes in multi-asset class funds and short-term notes. DiversyFund has no account minimums or management fees, making it a great option for passive investors wishing to invest in private commercial real estate.

You can invest in the company’s REITs if you have a net worth of at least $1 million or an annual income of $200,000, and they are open to everyone, not just accredited investors. A real estate investment trust (REIT) is a company that invests in and manages income-producing assets. Simply put, investing in a real estate investment trust (REIT) is equivalent to simultaneously investing in multiple real estate projects.

Is a DiversyFund investment right for you?

REITs own a variety of real estate assets, including hotels, rental units, and shopping malls. On the other hand, the Growth REIT concentrates on multifamily properties. To put it another way, your $500 investment grants you access to all of DiversyFund’s current multifamily properties. DiversyFund manages each real estate project from start to finish and profits alongside you because it owns all of the real estate assets it sells. Furthermore, it says that each investment will yield a 7 percent preferred return.

Real estate developments do not become profitable for the company until investors receive 100% of the earnings up to 7%. DiversyFund has a lower minimum investment than similar real estate apps like CrowdStreet ($25,000) and Yieldstreet ($1,000 to $10,000), but it still requires $500 to get started. You will not be able to withdraw your earnings from DiversyFund’s Growth REIT until the real estate assets, or properties, are sold, as it is a public, non-traded real estate investment. This is the case because dividends and earnings are reinvested until the firm sells its real estate holdings. DiversyFund holds property in California, North Carolina, and Texas, among other states.

A collection of instructional resources is provided below:

DiversyFund also includes an instructional blog library covering a variety of topics such as investing, business, news, and personal finance. The following subjects have been covered so far:

- Dummies’ Guide to Investing

- Investing strategies that are more sophisticated

- News & Updates

- Individual Financial Situations

- The Founders’ Forum

- Buying and Selling a Residence

- You can also receive investment alerts and articles by email.

The DiversyFund platform allows you to invest in a wide choice of funds

This endeavor requires accredited investor status and a minimum investment of $25,000 to participate. Investors are aiming for a 10X return on a minimum two-year investment in the company after the IPO, which is projected to take two to four years.

In general, how reliable is the DiversyFund company?

DiversyFund currently has an A+ rating from the Better Business Bureau. This is the highest possible rating a company can receive, and it usually means the organization excels in both business procedures and customer service. When it comes to grading firms, the BBB considers a variety of factors. The company’s complaint history, type of business, length of time in operation, licensing and government actions, and advertising difficulties, to name a few, are all factors to consider. DiversyFund has never been a party to a major lawsuit. In the last three years, the business has effectively resolved seven concerns.

The DiversyFund Series A Round begins with this installment. DiversyFund does not offer another REIT; instead, this is a direct investment in the business. DiversyFund Growth Investing REIT is similar to investing in a REIT, with all of the benefits that entail.

Here are a few of the benefits:

- REITs have outperformed the S&P 500 in recent decades.

- REITs must distribute at least 90% of their taxable income as dividends to their shareholders.

- Real estate investment trusts (REITs) can help you save money on taxes. When you buy real estate, you’ll have to deal with depreciation, which is a paper cost that eats into your profits.

- In the same way that mutual funds contain a variety of assets, real estate investment trusts (REITs) do. This provides a level of diversification that can’t be reached by holding just one property in a mutual fund.

- A commercial real estate investment adds variety to a portfolio that is primarily paper-based. When paper assets fail, the physical properties that REITs invest in may do well.

- Real estate can be used to protect against inflation. As inflation accelerates, real estate, on the other hand, is likely to gain in value.

- Real estate investment trusts (REITs), like mutual funds, are another type of passive investment. You are not obligated to participate in the management of the fund’s assets.

If you want to put money into the company’s upcoming Real Estate FinTech Platform, now is the time to do so. By being the “go-to” platform for everyone else, it hopes to become the “go-to” platform for investors searching for alternative investments.

How to Use DiversyFund Investing to Diversify Your Portfolio

DiversyFund allows you to register for free. You must be at least 18 years old and a US citizen or resident with a valid Social Security number. The entire account opening process will be completed online. You can use either Facebook or LinkedIn to sign up for an online application. In the online application, please include your complete contact information, including your name, email address, and phone number. At this moment, create and confirm a password. All you have to do now is click “Create Account” and you’re ready to go.

Is investing in DiversyFund a wise idea?

Most investors are aware of the importance of diversification. Many investors, on the other hand, stick to predetermined shares and bond allocation. Incorporating real estate into your financial portfolio might provide even more diversification. It prevents you from putting all of your money into financial investments. DiversyFund excels in commercial real estate, one of the most profitable divisions of the real estate business. The world’s wealthiest people, both in the United States and others, tend to invest in it. DiversyFund also has multifamily housing buildings as an advantage.

Rents generate cash flow, but multifamily properties also bring long-term financial gains. DiversyFund can help you diversify your real estate holdings. Real estate investment trusts are subject to the same restrictions as any other type of financial asset. You don’t have to buy property, find tenants, collect rent, pay building expenses, or evict renters the way you would if you owned the property outright. Make a deposit and start receiving dividends on a regular basis. The first step in the investing process is now complete.