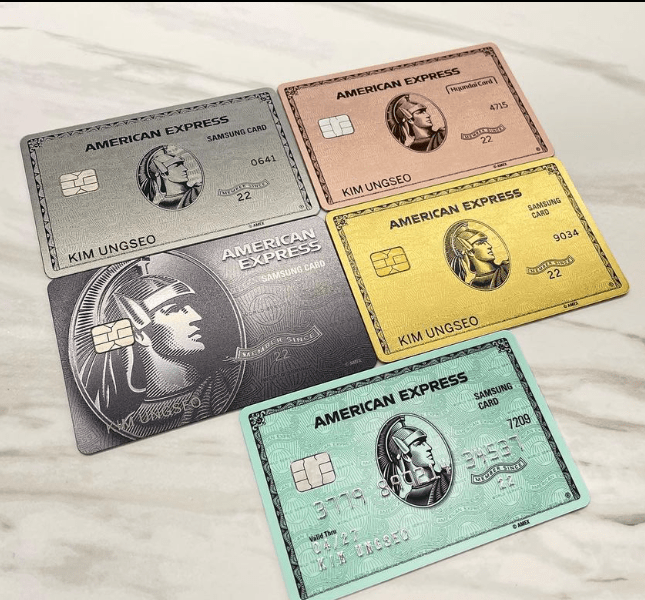

Amex Early Access To Official Platinum: This is the best credit card for airport lounge access and other upscale travel perks, thanks to a 100,000-point welcome bonus and a slew of new perks. Platinum Cardholders can get up to $1,800 in value from the current 100,000-point welcome bonus, which doesn’t include the bonus points you can earn on US Shop Small and Worldwide restaurant purchases in the first six months of your card membership.

Although Amex Platinum is a good card, is it right for you?

The American Express The Platinum Card® is a must-have if you’re looking for a high-end rewards card with perks like airport lounge access and travel statement credits. There is a $695 annual fee (see rates), but you get access to luxurious Centurion lounges at airports around the world. The Platinum Card has added new perks, such as digital subscription credits** and Equinox membership credits**, to help offset the higher annual fee since it was recently raised. These perks include complimentary Marriott and Hilton elite status, as well as $200 in annual airline fee credits. This is probably not the best credit card for your needs, even if you travel frequently.

With the Platinum Card, you can transfer American Express Membership Rewards points to over a dozen travel partners, including airlines and hotels. You’ll also get 100,000 Membership Rewards points as a welcome bonus after spending $6,000 in the first six months of card membership, which you can use to jumpstart your award travel. After spending $5,000 in the first three months, the standard welcome bonus is 60,000 points, but you can now get an extra 40,000 points. The Platinum Card’s main competitor is the Chase Sapphire Reserve®, which has a $550 annual fee.

How Make Most of Your Membership Rewards Point

Membership Rewards points, the currency of Amex’s loyalty program, are earned with the Platinum Card. You can exchange them for statement credits or cash back, the book travels through Amex’s travel website, or transfer them to one of 18 airline or hotel transfer partners. Because Membership Rewards points don’t have a set value, determining how much they’re worth can be difficult. To get a sense of how much each Amex point is worth, Insider’s rewards experts created a set of point and mile valuations, which puts the average value of each Amex point at 1.8 cents, though it’s possible to get a much lower or much higher value depending on how you use them.

If you’re looking for high-value options for using your points that don’t involve travel, Pay Yourself Back allows you to redeem points for eligible purchases with a 50% bonus with the Chase Sapphire Reserve®. The new Capital One Venture X Rewards Credit Card offers some upscale perks for a low annual fee of $395. You’ll get 75,000 bonus miles as a welcome bonus if you spend $4,000 on purchases within the first three months of opening your account. Priority Pass and Capital One lounge access, as well as up to $300 in annual Capital One travel credit, are all included. The Platinum Card, on the other hand, is difficult to beat if you travel frequently and want as many hotel and airport lounge perks as possible.

After spending $6,000 in the first six months of card membership, the Platinum Card offers 100,000 Membership Rewards points. According to our calculations, 100,000 points are worth about $1,800, which covers the annual fee for more than two years. You could get a much better deal if you transfer points to airline frequent-flyer programs and use them to fly round-trip to Europe — or even one-way in first class. It can be frightening for your child to travel alone for the first time, but you can share the benefits of Card Membership with them by adding them as an Additional Card Member on your account.

Chase Your Bonus If You Upgrade American Express Card

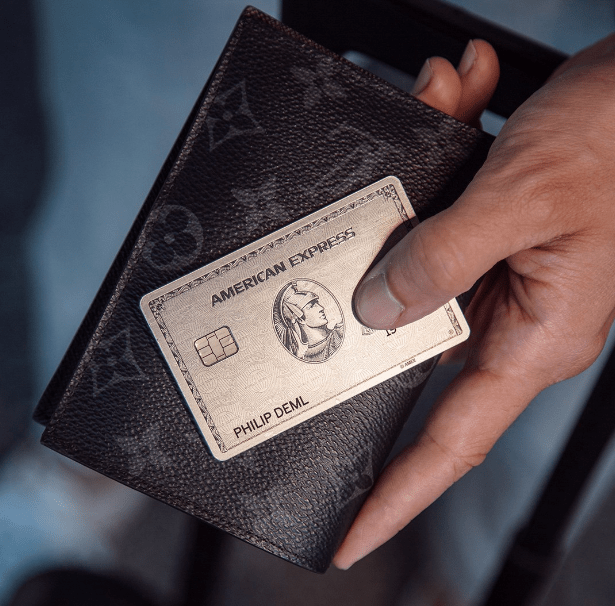

In today’s Whine Wednesdays, I’d like to remind our readers to think about whether upgrading their current American Express card to a higher card product is really worth the hassle. Amex sends out targeted promotions to existing card members from time to time, offering to upgrade to a higher card tier in exchange for a certain number of bonus points after meeting a spending threshold. These offers appear more frequently in your online account under “Card Portfolio” and when you search for pre-qualified card offers.

When the pandemic began last year, I downgraded my U.S.-based Platinum card to green and haven’t used it since, except to renew my CLEAR using the card’s credit. I checked my card offers in mid-March and discovered the following promotion to upgrade to the Platinum card once more: Since I used to have the Platinum Card, I’m no longer eligible for any Amex direct signup bonuses, so upgrade offers are as good as it gets for me. If you’ve never had the card product you want to upgrade to, you might be able to get a better deal by opening a new account instead of upgrading.

This offer coincided with the purchase of air tickets for family members that totaled US$2000, meaning the spend threshold would be met right away, and I’d also earn another 10,0000 membership rewards points in the process. In addition, the PayPal credit promotion was still active for another four months, bringing the total to $120. I decided to proceed with the card upgrade request, which was immediately approved. Following that, I made my purchases, paid the pro-rated annual fee for the remainder of the membership year, and checked for my points on a regular basis. Over the course of two months, nothing was credited, so in early June, I decided to pursue Amex and request my 25,000 points.

All I can say is that, thankfully, I did a lot of that over chat

So there is complete proof of what was communicated in the form of documentation. Before making the charge, I asked Amex if the amount would count towards the threshold before receiving the actual card, which the representative confirmed. Needless to say, the 22nd of June was on the calendar yesterday, but no points. Based on social media and bulletin board posts, this appears to be an ongoing issue with American Express. People are complaining about it all over the place, and many say they’ve given up hope of ever receiving the points because Amex claimed there was “no record of the offer.”

I contacted Amex customer service and requested that this be escalated to a mediation case with an outside entity that Amex (like other banks) uses to resolve customer complaints. External mediation costs several hundred dollars and is paid for by the institution rather than the customer. After that, the agent put me on hold for about 30 minutes while she researched the case. There was a lot of paperwork to sort through. When she returned, she apologized profusely, claiming that not only had the system failed to properly post the points but that there had also been a serious miscommunication by other customer service representatives.

Conclusion

It took a lot of time and effort to finally get my points after meeting all of the requirements outlined in the promotion’s terms and conditions. It would be one thing if this was an isolated incident, but there have been numerous reports of Amex conveniently losing track of these offers and then sticking the customer. The entire customer service experience was terrible. The only reason I upgraded the card is that the $120 PayPal credit, the 2x $200 airline credit, and the 25,000 points essentially pay for themselves over the next year. Except for the Amex Lounge Collection for Plaza Premium, I ignore the other extras because they’re mostly useless to me.